How to donate / Tax Benefits

| TOP | President's Messege | Notice from JAIST Foundation | Donation / Support project |

How to donate / Tax Benefits |

Donors | Hokulink Point Donation |

- TOP

- President's Messege

- Notice from JAIST Foundation

- Donation / Support project

- How to donate / Tax Benefits

- Donors

- Hokulink Point Donation

How to donate

You can support us by making an online payment (credit card, convenience store, Pay-easy), a bank transfer or a cash donation.

1. Donation via internet

If you make donation by online payment(credit card, convenience store, Pay-easy), please apply from here:

(1) Payment by credit card

Following credits cards are available for donation.

・Only one-time payment is acceptable.(Installment payments, lump-sum bonus payments, etc. are not acceptable.)

・In principle, no refunds or changes will be accepted after payment has been made.

・Donations will be debited to your account in the same manner as regular credit card use.

・Please check the statement that your credit card company sends you. You will see the description as "JAIST Foundation" on it.

・Your credit card company may contact you if your account cannot be charged.

(2) Convenience store payment

Following convenience stores are available for donation.

・After the reception is completed, you will receive an email with the payment method. Please proceed accordingly.

【Note】

・For convenience store payment, the maximum amount per transaction is 49,000 J. Yen.

・If you cancel the donation, please contact JAIST Foundation Office. Refund at the convenience store is not available.

(3) Pay-easy payment (Internet banking)

You can use this service if you have an Internet Banking account with a financial institution that offers this service.

The “Payment method” is shown on the display of “the reception completed”. Please proceed accordingly. 。

*Please refer to the below for the financial institutions that offer this service.

(4) Security

SSL encryption is used for transmission of application information to ensure a high level of security, and a dedicated server is used to improve security.

Please understand that JAIST cannot be held responsible for any damage caused by your application, except for reasons attributable to JAIST

2.Donations by bank transfer or cash

If you make donation by bank transfer or cash, please apply from here:

*1,000 yen per unit for individuals and 10,000 yen per unit for corporations.

*1,000 yen per unit for individuals and 10,000 yen per unit for corporations.

*Please note that we cannot always accept your donation if it is a conditional offer, or it is considered to affect execution of duties of JAIST or to be inappropriate for us to accept the donation for social reasons or by judgement of the president.

(1) Bank transfer

You are requested to transfer the donation to the bank account designated by JAIST. The bank account for remittance will be emailed to your email address entered in the “Application Form”. If you use the JAIST Transfer Form to make the transfer of funds from the counter of the head office/branch office of Hokkoku Bank or Hokuriku Bank, there will be no service fees. However, you will be charged a handling fee if you make the transfer at other financial institutions including post offices and Japan Post Bank. Please note that you will have to bear the fee.

(2) Cash donation

Please come directly to the General Affairs Department (JAIST Foundation Office) in JAIST Administration Building (3rd floor) to make donations. We can accept cash only.

*Operation hours:8:30~15:00(Except Saturday, Sunday and Holidays)

3.Issuance of the certificate of receipt

(1) For credit card payment, convenience store payment and Pay-easy payment

・Please note that it may take up to 2-3 months from the date of our confirmation of receipt of your donation to the issuance of the thank you letter and the certificate of receipt.

・The date of certificate of receipt is not the date of donation, but the date the donation was received by JAIST.

If you apply for donation in December, the date of certificate of receipt will be the end of January, next year and deduction for donations will be made next year.

(2) For bank transfer and cash donation

・Please note that it may take up to 2-3 weeks from the date of our confirmation of receipt of your donation to the issuance of the thank-you-letter and the certificate of receipt. The thank-you-letter and the certificate of receipt will be sent to your address by post.

・For bank transfer donation, the date of the certificate of receipt is not the transfer date, but the date the donation was received by JAIST.

4. Recommendation of the Medal with Dark Blue Ribbon

The Medal with Dark Blue Ribbon is one of the national medal systems, and is awarded to those who have donated private property (individuals: 5 million yen or more; corporations, etc.: 10 million yen or more) for the public good.

For more information, please see the file below.

Tax Benefits

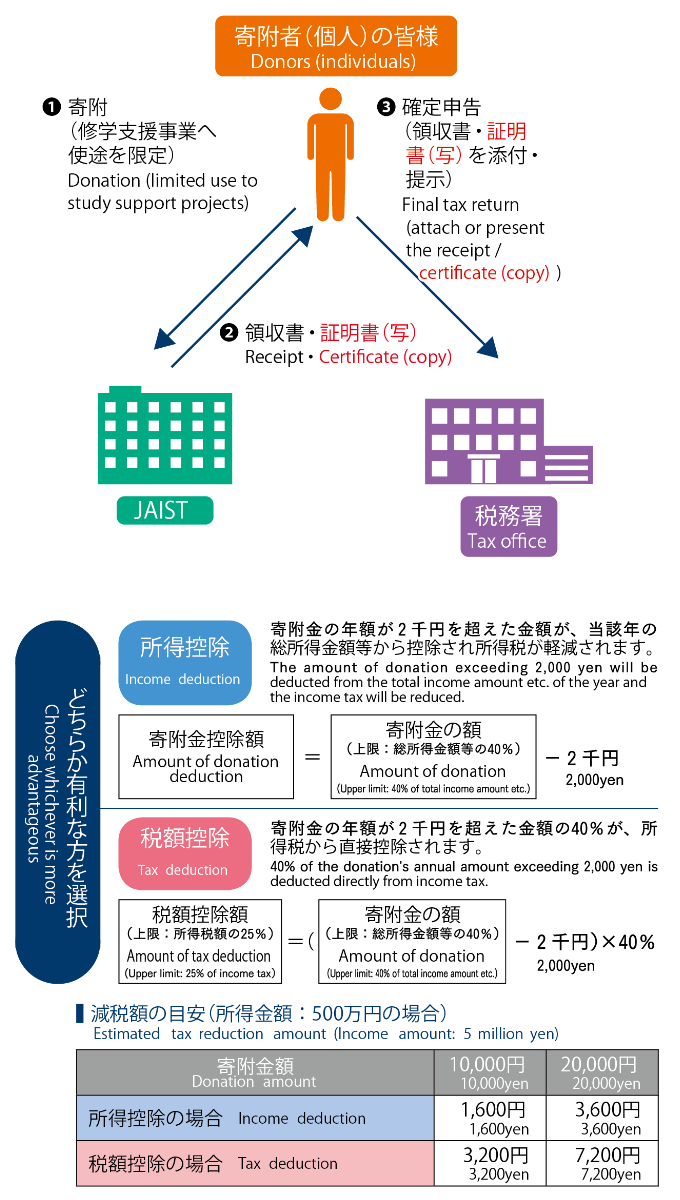

Donations to the JAIST Foundation are subject to tax benefits. Please file a final tax return procedure with a receipt issued by JAIST.

Donation by Individuals

| Income Tax ・Reducible Amount of Income Tax = (Donation Amount – 2,000yen) × Income Tax Rate |

Donations to the Education and Research Support Fund will be deducted from your income. Donations to the Study Support Fund will be deducted as either income tax or tax credit when you file your tax return.

Flow of donation to Study Support Fund

Residential Tax

In the case of donation by residents in Ishikawa Prefecture, it can be given deductions of residential tax for Ishikawa prefecture and its cities, towns and villages.

Donations made by parents or guardians of new students or by new students themselves at the time of enrollment may not be deductible for income and residential tax purposes according to the Income Tax Act. Please check with your local tax office fordetails.

Donation by Corporations

All amounts of donation to the JAIST Foundation are possible to include in deductible expenses for tax procedure. (cf. Article 37-3-2 of the Corporation Tax Act)

Contact

JAIST Foundation Office,

National University Corporation Japan Advanced Institute of Science and Technology

1-1 Asahidai, Nomi, Ishikawa 923-1292 Japan

TEL 0761-51-1059

Operation Hours : 8:30~17:15

(except weekends and holidays)

E-mail: kikin@ml.jaist.ac.jp

copyright © 2010 Japan Advanced Institute of Science and Technology. All rights reserved.